| HOME | NEXT |

MV Dali impacts far and wide

By Deb Eccleston

The MV Dali incident has reignited calls for reform to Australia’s marine insurance laws.

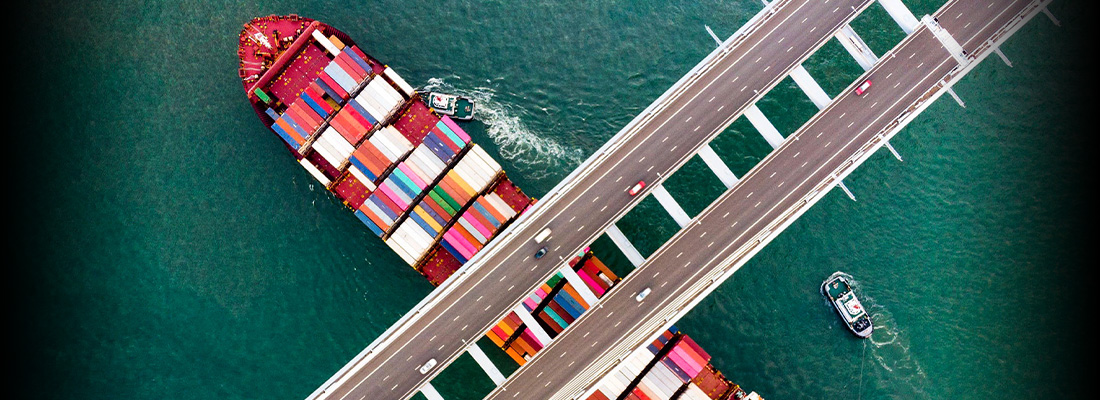

Shockwaves were felt across the globe as images of the MV Dali ploughing into the Francis Scott Key Bridge in Baltimore, USA, were broadcast across news outlets and social media in March.

The incident, which brought maritime traffic in and out of the Baltimore harbour to an immediate standstill, has been a hot topic of discussion in the insurance industry.

According to NTI Head of Insurance Risk and Reinsurance Andrew Kidd, the publicity surrounding the tragedy has sparked unprecedented interest in the impact of maritime disasters.

Speaking at an AILA webinar – Navigating the waves and the casualties: Marine insurance in Australia and the impact of the Baltimore incident – Mr Kidd said social media had thrown a spotlight on the challenges faced by the marine insurance industry.

Real-time video

It’s not the first time a maritime disaster of this scale has occurred – billion-dollar losses were suffered from the Costa Concordia that struck rocks off Italy’s western coast in 2012 ($US2 billion), the Tianjin port explosion in 2015 ($US9 billion) and the Evergiven that disrupted supply through the Suez Canalin 2021 ($US1 billion for cargo alone). But it’s the first-time real-time video was captured.

“MV Dali is the topic of the day in the marine insurance market,” Mr Kidd said.

“Imagery is far more available – the MV Dali brings home that people have their phones taking videos as they happen.

“I think that’s the highlight here – people are getting an appreciation of what these incidents look like.”

The MV Dali incident also highlighted long-standing issues with the Marine Insurance Act 1909 (Cth), Sparke Helmore partner Michelle Taylor told the webinar.

The Marine Insurance Act applies to a contract of marine insurance, which is a contract whereby the insurer indemnifies the insured against losses incident to a “marine adventure”. Mixed sea and land risks are included under the Act, which Ms Taylor said has caused a great deal of angst and litigation over the years.

Limit liability

The Convention on Limitation of Liability for Maritime Claims (LLMC) enables shipowners to limit their liability to pay compensation for general ship-sourced damage. The LLMC applies to claims for loss of life and personal injury, and for loss of or damage to property.

In the case of the MV Dali, Ms Taylor said limitation of liability proceedings in the US District Court of Maryland seek to limit liability to US$42.5 million. Insured losses from the incident are estimated at between US$3 billion-US$4 billion.

If the owners of the MV Dali are found liable, claims will fall to global insurers of the International Group of Protection & Indemnity (P&I) Clubs.

“This disaster highlights the importance of marine insurance law and how different regimes will respond to these losses and the impact these losses can have on the global marine insurance market,” Ms Taylor said.

Major maritime incidents have been a catalyst for marine law reform throughout history. Ms Taylor said Australia has had two opportunities to reform the Marine Insurance Act but hasn’t done so on either occasion.

Reform opportunities missed

The first was when the Insurance Contracts Act came into being in 1984, but the Marine Insurance Act was specifically excluded. The second opportunity was in 2001, when the Australian Law Reform Commission terms of reference specifically focused on the Marine Insurance Act, but its report recommended only minor changes and even fewer were enacted.

“While there are many terms in the Marine Insurance Act that we could consider today to be obsolete or out of step with our commercial and social environments, it apparently is unretractable,” Ms Taylor said.

After the United Kingdom enacted the Insurance Act 2015, which came into effect in 2016 and introduced substantial amendments to the UK’s Marine Insurance Act, the Insurance Council of Australia (ICA) wrote to Australia’s Attorney General at the time raising concerns about how Australia’s marine insurance was now out of step with the English reforms.

“The ICA said our Marine Insurance Act was in need of reform to comply with global expectations. But nothing happened,” she said.

Likely claims

So what happens next for the world’s marine insurance industry in the wake of the MV Dali allision with the FSK bridge?

In terms of claims process, Mr Kidd said the priority will be settling with the families of those killed and injured.

He said likely claims to arise include:

- Wrongful death

- Remove of debris, which will likely be “expensive but not excessive”

- Salvaging the Dali, which will take time to ensure it doesn’t break up in the process and to salvage the 5,000 “boxes” on board

- Rebuilding the bridge (Chubb is the lead insurer for US$1.2 billion)

- Business interruption

- Port and terminals

- PTSD (for the Dali crew and pilots on board)

- Cargo losses/costs (40 vessels offshore from the port had to be rerouted)

- Port blocking and trapping.

“The market expects that limitation of US$45 million to be broken,” Mr Kidd said.

“There is an army of lawyers working on this case already – I think the P&I Clubs have appointed five firms already to act in defence – and there’s an army of other lawyers trying to break limitation on this.

“Whether the limitation holds or not is the million-dollar question that everyone is second guessing.”

The International Group, which includes the top 12 P&I clubs, insuring 90% of the global tonnage, manages reinsurance for the group.

It is structured so that Dali’s P&I club, Britannia, takes the first US$10 million, then the 12 members, proportionately according to their size, take the next US$90 million, followed by reinsurance to $US3.1 billion.

With 60 companies reinsuring the International Group, “everyone has a piece of this and lawyers know how deep the pockets are”, Mr Kidd said.

Resolve is the official publication of the Australian Insurance Law Association and

the New Zealand Insurance Law Association.